How inflation is changing the insurer landscape

We look beyond the headline numbers to assess where the current inflationary pressures are being felt most, the outlook for FY24 and what insurers can do to thrive over the next few years.

Our analysis shows we’re past the inflationary peak for most sectors, but inflation continues to remain above long-term average levels and will increase claims cost pressures for insurers. Indeed, in its recent report on the Australian economy, the International Monetary Fund said headline inflation’s “decline is slow and core inflation remains sticky”. At a minimum, insurers will need to have a deep understanding of the drivers of inflation for each loss type and the flow-on impact on claims costs and premiums.

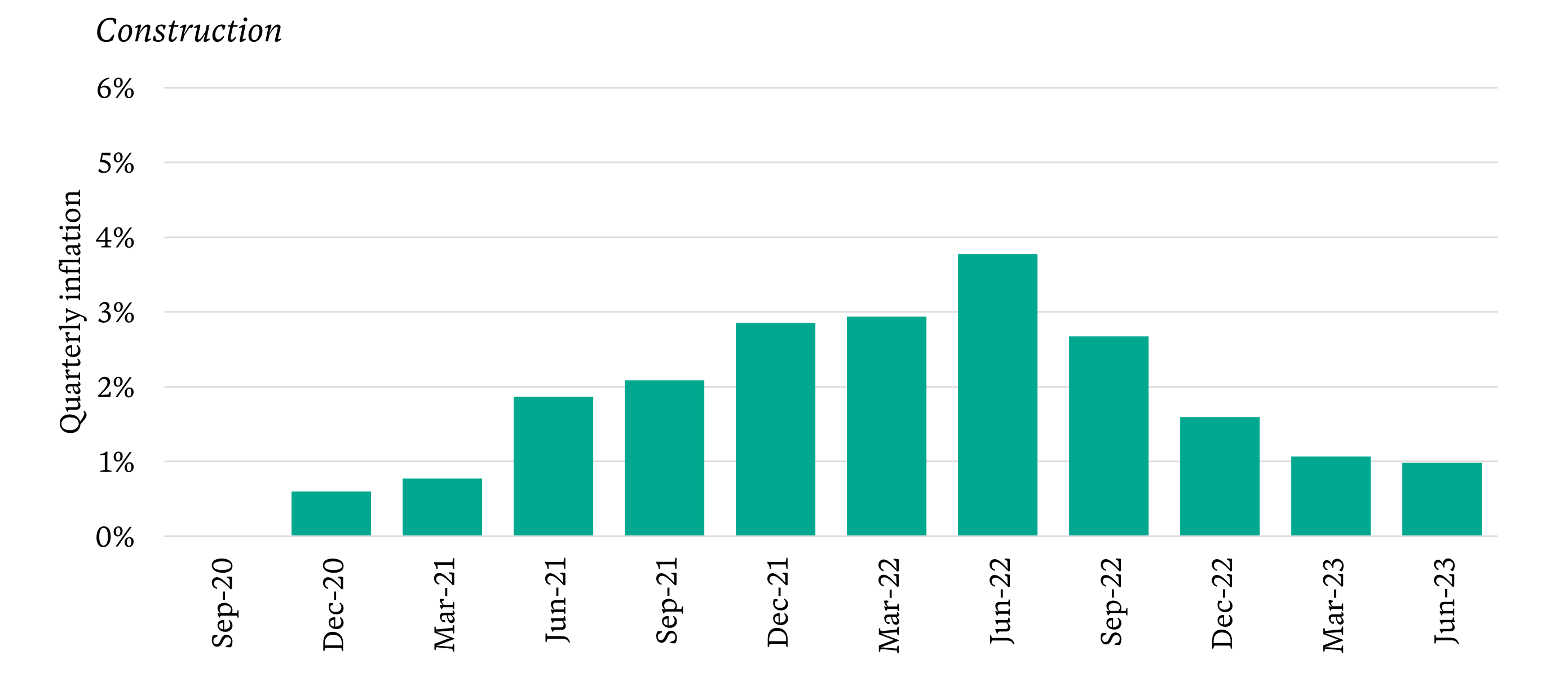

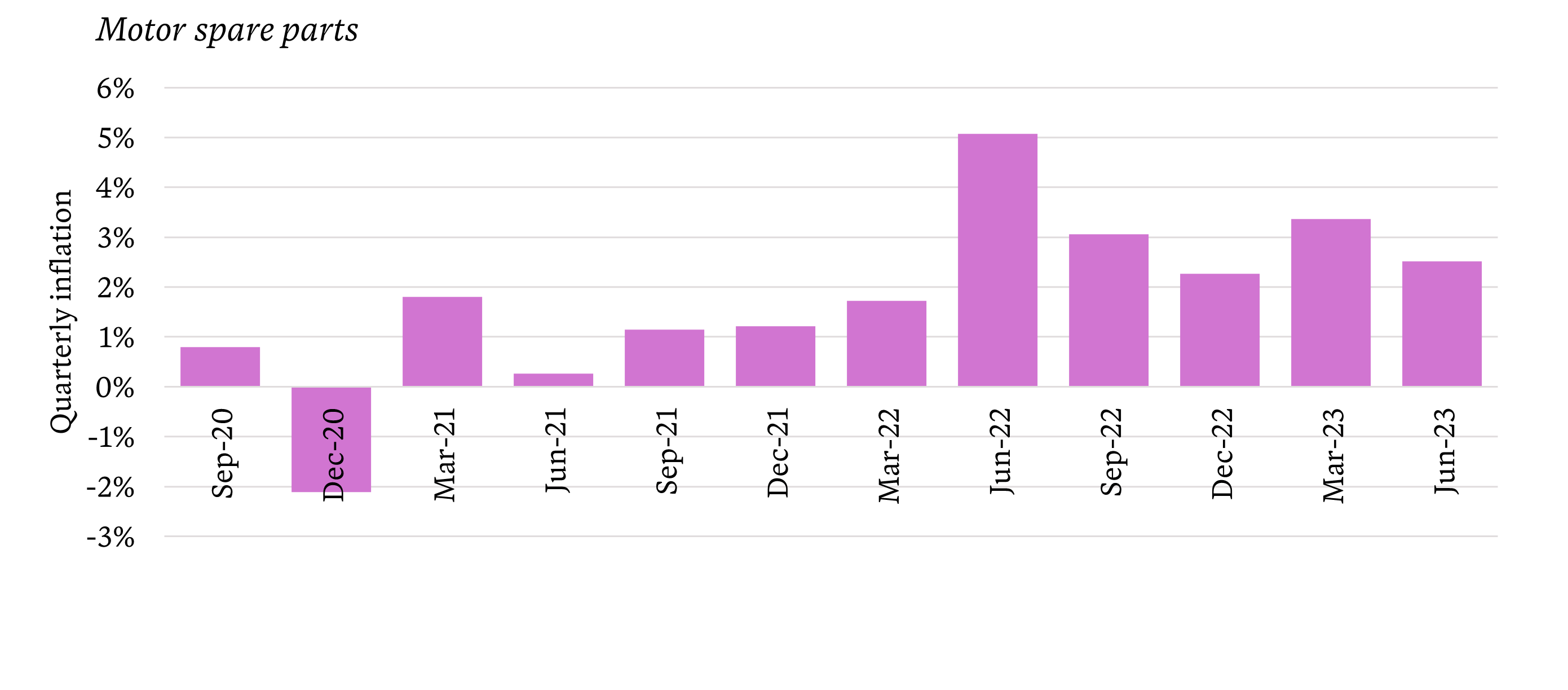

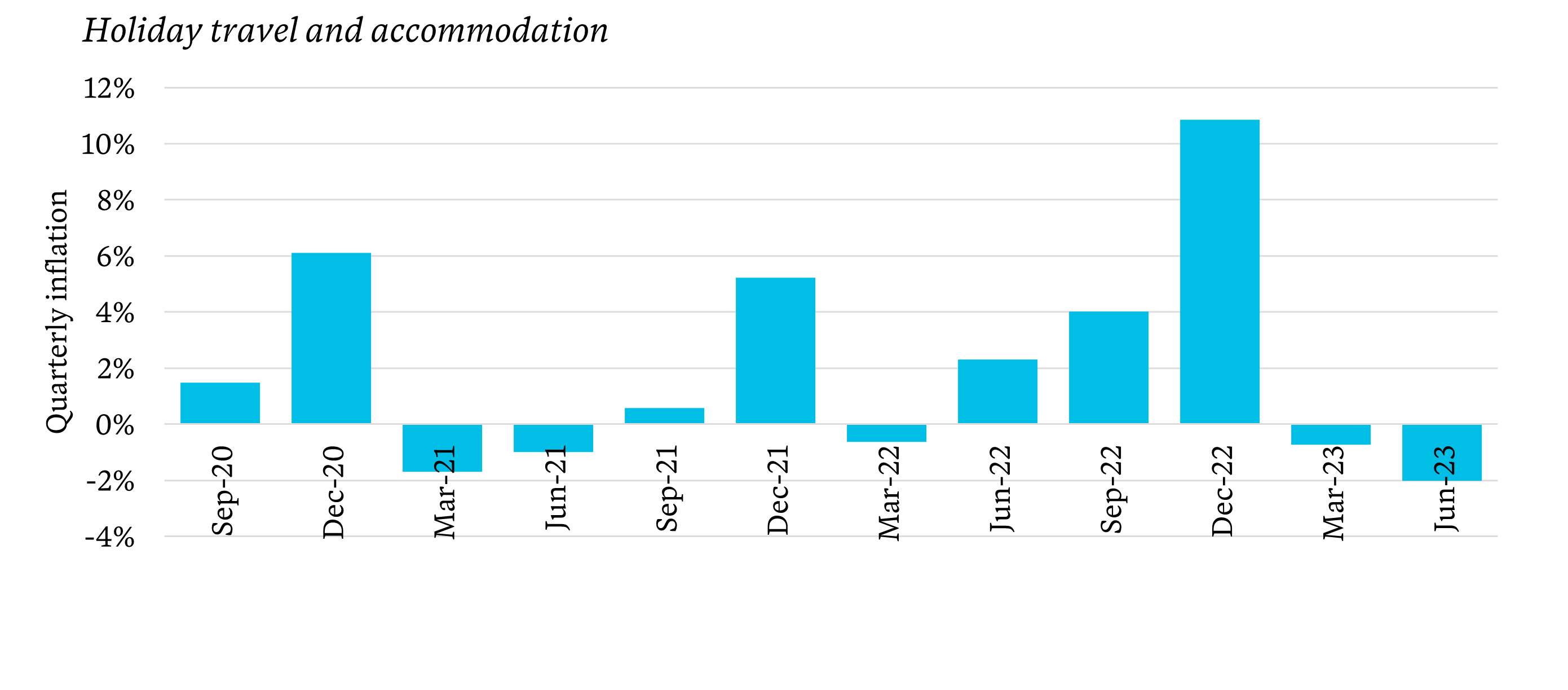

Construction, motor parts and travel are key drivers of claims cost inflation for property, motor and travel insurers. We summarise the Australian Bureau of Statistics quarterly inflation figures for the three areas to help us capture the impacts on insurers.

With claims costs increasing, insurers will need to understand inflationary drivers and impacts

Key driver 1 – Construction

Over the two years to 30 June 2023, construction costs have increased by 20%. Cost pressures have been driven by an increase in demand for materials combined with supply constraints and increases in energy and freight costs. The good news is that the past two quarters show construction cost increases are slowing. We expect material cost pressures will reduce over FY24, as supply chain pressures reduce and demand weakens.

Of course, the cost of construction is only one of the factors contributing to claims costs and premiums. Unfortunately for homeowners, the increasing frequency and cost of catastrophes and increases in reinsurance costs continue to drive up premiums, despite the weakening inflationary pressures on construction costs. IAG increased home insurance premiums by 20% from February 2023.

In its recent thought leadership report, Home Insurance Affordability Update, the Actuaries Institute states 12% of households are now affordability stressed, paying more than four weeks’ gross income towards home insurance premiums. Various initiatives and measures to mitigate these risks have been proposed but will take time. Meanwhile, affordability stresses will further increase as the risks continue to rise and insurers are flagging additional premium increases.

Construction cost increases are slowing, but catastrophes continue to drive up premiums

Key driver 2 – Motor spare parts

Motor parts costs have increased by 23% in the past two years. Supply chain constraints and labour shortages are mainly behind increases in claims costs for insurers. Advancement in technology used in vehicle components is another key contributor. In particular, components that are most likely to be damaged in a collision such as headlights and windscreens have seen sharp price increases due to technological advancement in modern vehicles, including advanced driver-assistance systems and smart sensors.

The increase in motor parts costs has impacted motor insurance premiums over the past few years. Reflecting this experience, APRA’s latest general insurance statistics show a 14% increase in average premiums over FY23 for the industry.

We expect motor vehicle cost pressures to remain elevated in FY24. The main pressures over the next year come from labour shortages in the motor repair industry and the supply of spare parts, which will have an impact on repair times and costs.

APRA reports a 14% increase in average motor premiums and we expect cost pressures to remain

Key driver 3 – Holiday travel and accommodation

In good news for travellers, the cost of travel and accommodation reduced by 3% in the six months to June 2023, following record high prices last summer. The price increases in the past two years are due to a combination of increased demand post COVID-19, the cost of aviation fuel and reduced supply of air travel.

The outlook is for prices to reduce further as supply comes back online. Travel insurers will need to watch this space closely and adjust premiums to remain competitive.

Prices for travellers should further reduce from earlier record highs, as supply comes back online

Top 4 insurer actions – What it will take to thrive

In addition to closely monitoring claims costs and adjusting premiums, there are several actions insurers can take to thrive in this environment:

- Focus on customer retention strategies, given substantial price increases – Price is not the only factor that determines whether a customer renews. Improving customer experience – at the time of acquiring a policy or receiving a claim and when responding to a customer enquiry – is now more important than ever. For example, claim settlement times are being slashed with the industry investing in technology and artificial intelligence to help reduce the time it takes to assess a claim from weeks to minutes. The standout in this space is Lemonade Insurance, setting a new record of paying a claim in under two seconds.

- Be alert to an increase in the number of vulnerable customers and review your financial hardship policies – Vulnerability is broad and can be situational. It’s important your customer service team is on high alert and can spot the signs.

- Consider the potential for increased fraud/claim exaggeration activity, as ongoing cost pressures hit home for consumers and businesses – In 2017, the Insurance Council of Australia reported insurers detected $280 million in fraudulent claims across personal lines classes. The true cost of fraudulent claims will be multiples higher than this and can be expected to increase in times of economic stress. The industry is investing in AI to detect fraud and flag claims for additional review. Provided these solutions are applied correctly, this is a positive development for consumers.

- Closely monitor customer churn, with a focus on retaining your most profitable customers – Large premium rate increases are associated with an increase in churn, as customers search for a better deal. In this environment, it’s increasingly important for insurers to understand profitability at a customer level and focus efforts on retaining customers who have a high lifetime value. Insurers that have a comprehensive understanding of individual risks and provide a great customer experience, as we outlined in Action 1., will be best placed to weather the storm.

Other articles by

Scott Duncan

Other articles by Scott Duncan

More articles

RADAR FY2024 – Strongest result in more than 10 years, but insurers in regulator sights

RADAR FY2024, Taylor Fry’s annual insurance rundown in a year of solid results alongside a focus on integrity, customers and climate.

Read Article

A practical business guide to the new design and distribution obligations (DDO)

ASIC’s design and distribution obligations offer firms a chance to realise greater business value and connection to their customers

Read Article

Related articles

Related articles

More articles

RADAR FY2024 – Strongest result in more than 10 years, but insurers in regulator sights

RADAR FY2024, Taylor Fry’s annual insurance rundown in a year of solid results alongside a focus on integrity, customers and climate.

Read Article

Win-Li Toh awarded Insurance Leader of the Year 2023

The Taylor Fry Principal was recognised for the “shining leadership”, collaboration and goodwill she has brought to the industry and beyond

Read Article